Our services

Reporting & Compliance

-

VAT registration

and reporting - Intrastat reporting

- Specialised services for e-commerce

jrd. in brief

Lat doświadczenia

0

+

WYKWALIFIKOWANYCH DORADCÓW

0

+

ZADOWOLONYCH KLIENTÓW

0

+

jrd. International

Our office is based in Warsaw, but we operate internationally.

We support entrepreneurs from across the EU, as well as from Switzerland, the United Kingdom, and Norway. Our German Desk and English Desk teams provide full-service support in German and English at every stage of cooperation – from accountants and tax advisors to legal counsels and certified auditors.

We are a member of:

News

A1 certificate – when is it required and how to apply for it?

- Bez kategorii

Mobility of employees across Europe offers companies many opportunities, but it also requires careful handling of formal requirements. One document that must not be overlooked...

Avoiding mistakes in disciplinary dismissals – part 2

- Labour law

Learn how to properly carry out a disciplinary dismissal step by step. Discover the rules, deadlines, and formal requirements that determine the validity of a...

Invoice correction to zero in KSeF and VAT liability: KIS position 2025

- VAT

Errors in invoices and their corrections may give rise to doubts regarding the amount on which VAT should be paid. The latest interpretation issued by...

Avoiding mistakes in disciplinary dismissals – part 1

- Labour law

Dismissal for disciplinary reasons requires caution. It usually has far-reaching consequences for the employee, but a mistake on the employer’s side can have serious effects....

From sole proprietorship to LLC – a guide, part 2

- Commercial Law

Transforming a sole proprietorship into a limited liability company involves not only formalities, but also legal, tax, and organizational consequences. It is advisable to take...

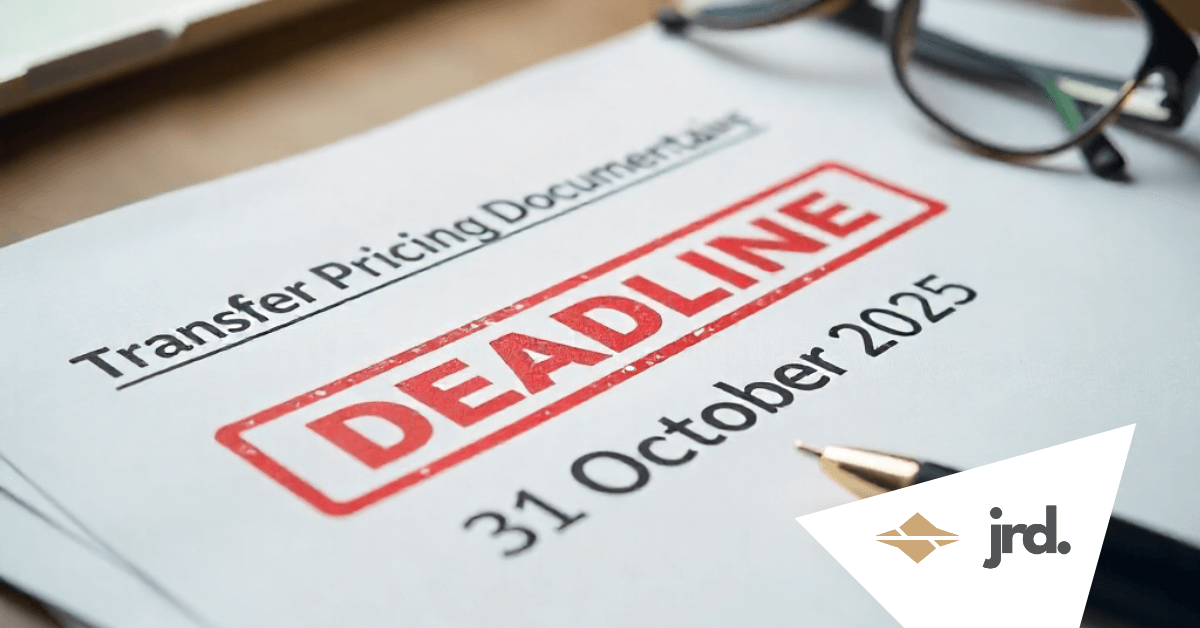

Transfer Pricing 2025 – Important Deadlines Approaching!

- CIT, EN, PIT

The deadlines for fulfilling your transfer pricing obligations for the 2024 tax year are fast approaching....